The Perversity of Risk

A conversation with a friend veered to how everybody is optimistic in the country and the indices and individual stocks are touching all-time highs.

I was reminded of this classic HM piece:

When everyone believes something is risky, their unwillingness to buy usually reduces its price to the point where it’s not risky at all. Broadly negative opinion can make it the least risky thing, since all optimism has been driven out of its price.

When everyone believes something embodies no risk, they usually bid it up to the point where it’s enormously risky. No risk is feared, and thus no reward for risk bearing. That can make the thing that’s most esteemed the riskiest.

This paradox exists because most investors think quality, as opposed to price, is the determinant of whether something’s risky. But high-quality assets can be risky, and low-quality assets can be safe. It’s just a matter of the price paid for them.

For me, it follows from the above that the bottom line is simple: the riskiest thing in the world is the widespread belief that there’s no risk. I call this “the perversity of risk.”

For long term investors, the increasing level of optimism of the overall market is a sign that the risk is increasing, whereas broad pessimism is a sign that the risk has reduced.

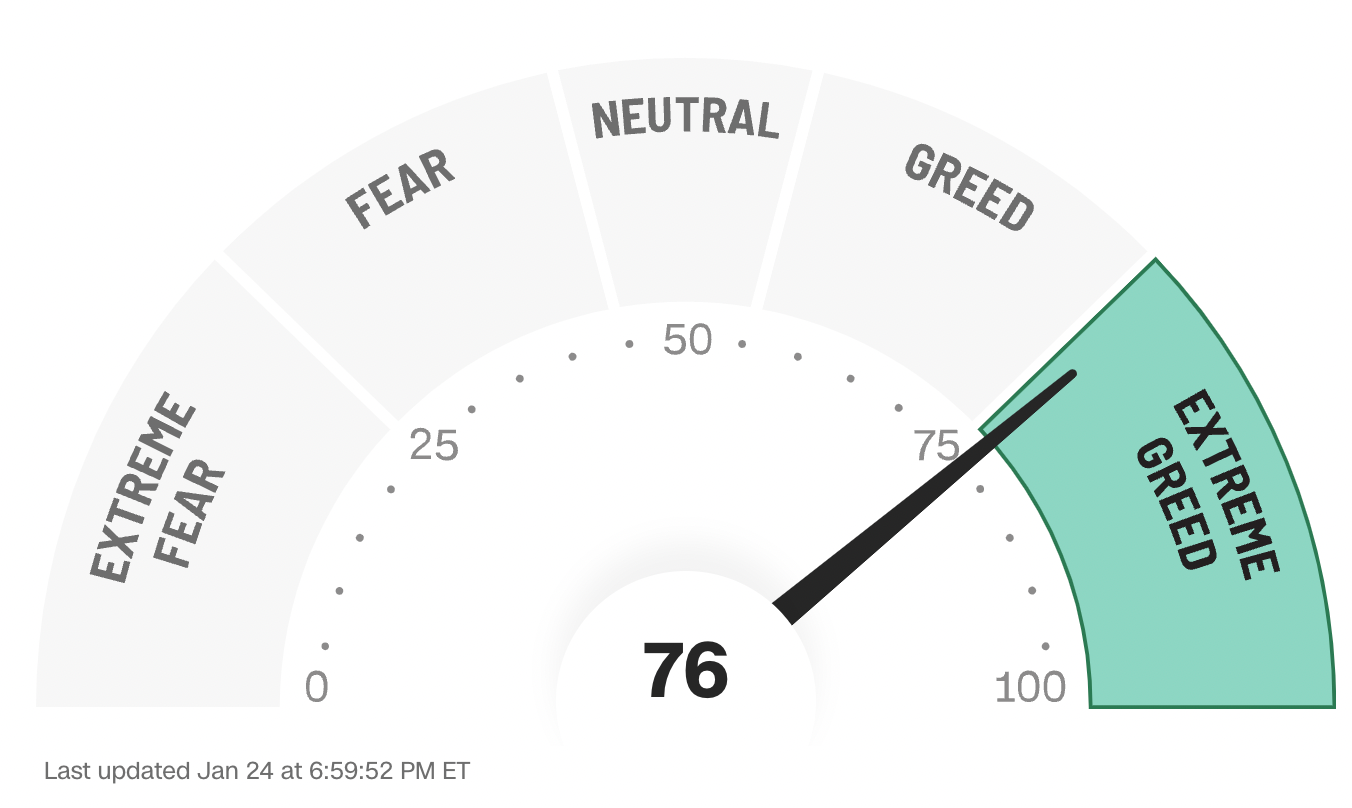

So, where are we in the cycle? In the Extreme Greed zone, which implies very high risks.

Does this mean that the market will crash or correct anytime soon? It's not so easy. As Keynes said, "the markets can remain irrational longer than you can remain solvent.”

But surely, for the long term investor, the correct stance at this stage is to be cautious.

A future correction – which is certain – will lead to lucrative opportunities, for which the investor needs to husband cash by periodically reducing their equity exposure.

Member discussion