Book Notes: “The Intelligent Investor” feat. Goddess Lakshmi

"The Intelligent Investor," a seminal work in the field of value investing, was first published in 1949 by Benjamin Graham, the renowned mentor of Warren Buffett.

Chapter 20, titled "Margin of Safety," introduces a concept that has since become a cornerstone of investment philosophy. It emphasizes the importance of purchasing securities at a price significantly lower than their intrinsic value to protect against unforeseen risks and market volatility.

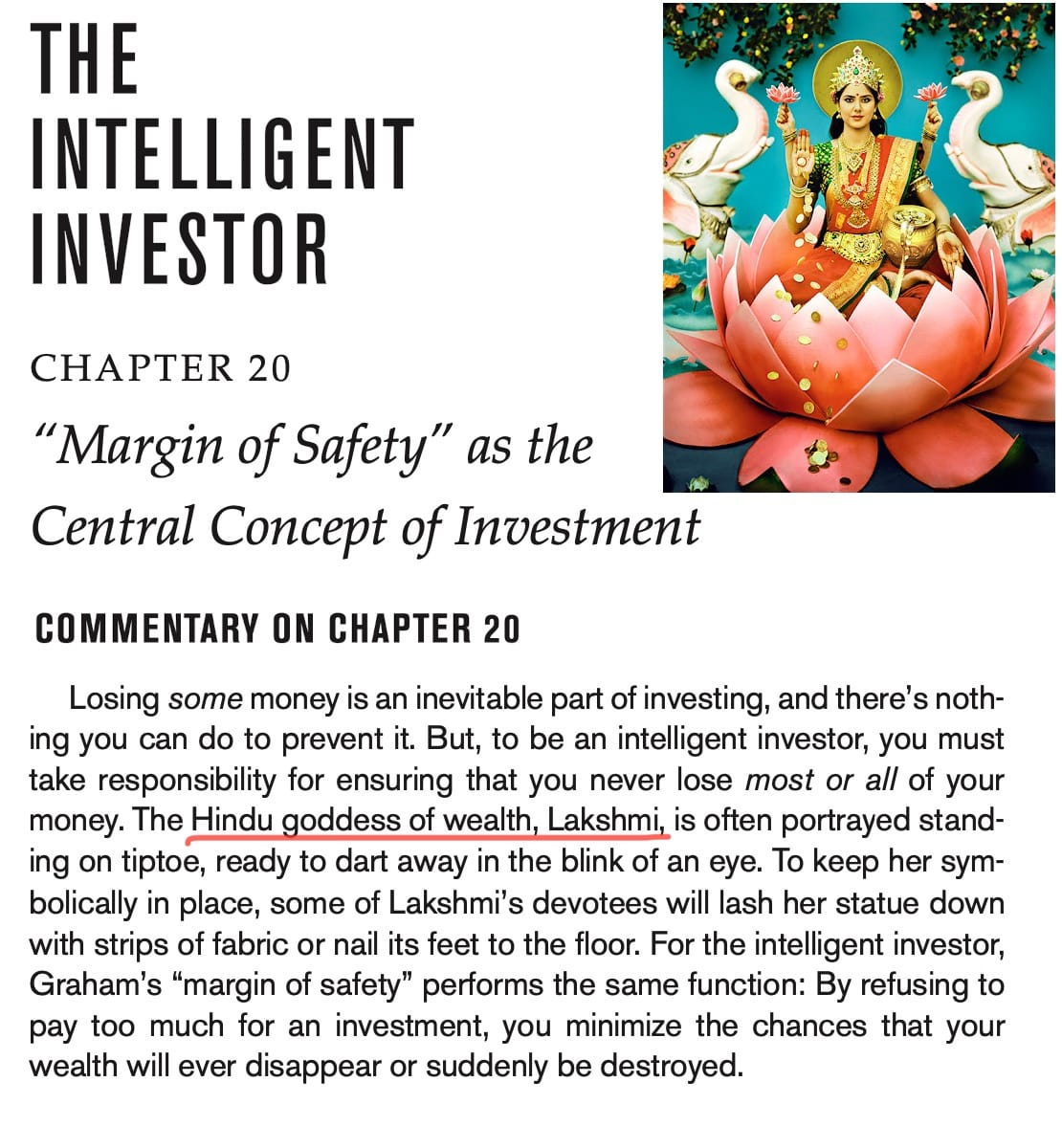

The revised (2005) edition of the original book has commentary on each chapter by WSJ's Jason Zweig. In the commentary on Chapter 20, Jason draws an analogy between the unpredictable nature of stocks and wealth and the Hindu goddess of prosperity, Lakshmi, who is known for her fickleness:

The Hindu goddess of wealth, Lakshmi, is often portrayed standing on tiptoe, ready to dart away in the blink of an eye. To keep her symbolically in place, some of Lakshmi's devotees will lash her statue down with strips of fabric or nail its feet to the floor.

For the intelligent investor, Graham's "margin of safety" performs the same function:

By refusing to pay too much for an investment, you minimize the chances that your wealth will ever disappear or suddenly be destroyed.

Below are some interesting quotes from this chapter:

- Margin of safety is all about the price.

The margin of safety is always dependent on the price paid.

..most of the fair-weather investments, acquired at fair-weather prices, are destined to suffer disturbing price declines when the horizon clouds over—and often sooner than that...the investor [cannot] count with confidence on an eventual recovery—although this does come about in some proportion of the cases—for he has never had a real safety margin to tide him through adversity.

- The margin of safety acts as an insurance against bad luck.

The margin-of-safety idea becomes much more evident when we apply it to the field of undervalued or bargain securities. We have here, by definition, a favorable difference between price on the one hand and indicated or appraised value on the other. That difference is the safety margin. It is available for absorbing the effect of miscalculations or worse than average luck. The buyer of bargain issues places particular emphasis on the ability of the investment to withstand adverse developments.

- Diversification goes hand in hand with the margin-of-safety principle.

Diversification is an established tenet of conservative investment. By accepting it so universally, investors are really demonstrating their acceptance of the margin-of-safety principle, to which diversification is the companion.

- The margin of safety is the key difference between investing and speculation.

We suggest that the margin-of-safety concept may be used to advantage as the touchstone to distinguish an investment operation from a speculative one.

- Price, and not quality, is the ultimate determinant of returns.

It is our argument that a sufficiently low price can turn a security of mediocre quality into a sound investment opportunity

- Value investing, while less exciting, can provide consistent returns with lower risk. Other strategies require more effort and luck to outperform consistently.

To achieve satisfactory investment results is easier than most people realize; to achieve superior results is harder than it looks.

Here are some thought-provoking excerpts from Jason Zweig's commentary on this chapter:

When he was asked to sum up everything he had learned in his long career about how to get rich, the legendary financier J. K. Klingenstein of Wertheim & Co. answered simply: “Don’t lose.”

You should always remember, in the words of the psychologist Paul Slovic, that “risk is brewed from an equal dose of two ingredients— probabilities and consequences.”

Simply by keeping your holdings permanently diversified, and refusing to fling money at Mr. Market’s latest, craziest fashions, you can ensure that the consequences of your mistakes will never be catastrophic.

Member discussion