Positioning for the Next Market Phase

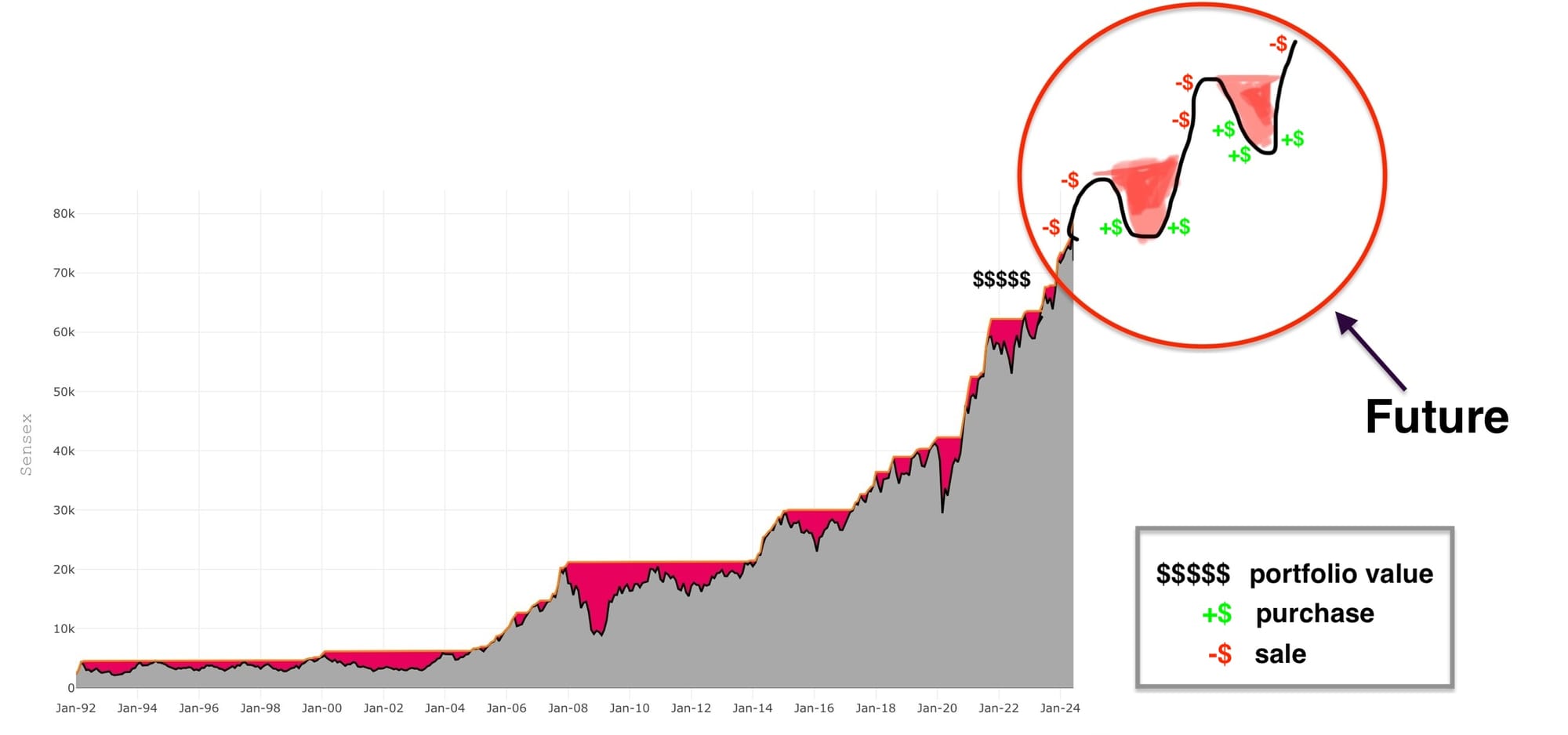

(This is the concluding post in a series reconciling stock price fluctuations. The first post explained stock prices using a mental model of Maxima & Minima, while the second focused on Drawdowns.)

Investors constantly feel like they’re on a rollercoaster, where every current event seems important. The reality is that most investors will invest for decades, until their death. There will be numerous bull markets and corrections throughout their life.

In this light, it is surprising why we don’t prepare for future eventualities and instead react with shock to every market shift.

This article attempts to put together a mental model for aligning with future market corrections. We cannot eliminate the impact of drawdowns, but we can at least cope with the fluctuations of the investment journey more effectively.

Through our explorations into Maxima, Minima, and Drawdowns, we have made some key observations:

- Markets can keep rising, and no one knows their limits. The peak of the market cannot be known in advance.

- Selling in bull markets feels foolish when stock prices continue to climb after the sale.

- Corrections cause markets to plummet to extreme lows. The bottom of the market is unknown in advance.

- Market declines are stressful and can easily lead to forced selling.

- The easiest profits come from buying in the bleakest market conditions. But, it is very challenging to buy at market lows.

- The markets will move from Maxima to Minima, and an even higher Maxima.

Let’s use these insights to deduce an action matrix for long-term individual investors.

In Bull Markets |

|

| Key action | SELL |

| ↳ When | Avoid selling until optimism is high and memories of the previous bear market have faded. |

| ↳ What | Sell a small % of the portfolio. Selling some stocks entirely can create unhealthy psychology if they increase further. |

| ↳ How much | Sell a small portion (e.g. 5%) of the portfolio every 6-12 months. |

| ↳ Aftermath | After selling, the market will continue to rise. |

| ↳ Mindset | The market rise after selling will lead to regret, which is the desired psychological state. |

In Bear Markets |

|

| Key action | BUY |

| ↳ When | Strong corrections generally lead to 20-25% drawdowns. It’s wise to wait before buying, as cash is limited. A good rule is to buy only when it is gut-wrenching. |

| ↳ What | Buying in a crisis is difficult. One can only aim to buy more of what they already have or understand thoroughly. |

| ↳ How much | Consider purchasing in 2-3 installments. Timing the bottom isn’t essential. |

| ↳ Aftermath | The market will continue to decline after buying, leading to losses. |

| ↳ Mindset | The immediate losses upon buying will lead to regret and introspection. However, this discomfort is an essential part of the investment process during bear markets. |

In this framework, the investor is expected to act only in the late stages of both bull and bear markets. The recommended actions counter prevailing market behaviors and are designed to induce regret, positioning the investor as a (minor) contrarian, which is the goal.

Selling during bull markets can be emotionally taxing, but it’s a valuable strategy. As the market continues to rise post-selling, the investor will experience regret, leading to resentment towards further gains. This mental state prepares them for the next cycle. Some may even privately wish for a pullback to invest their cash at more favorable valuations!

Looking foolish at market extremes is necessary for making money in the longer term.

It's important to note that the amount of selling isn't as critical as the act itself. Even selling a small portion can generate the necessary regret and emotional conditioning to navigate the next market downturn. For instance, selling just 5% and retaining 95% may still cause significant regret as the market continues to rise.

I recently spoke to a prominent HNI investor who was regretting selling a multi-bagger stock (that he had held for years), because it had sharply appreciated after his sale. Later, I gathered that he had sold only 20% of his holdings and continued to hold the rest!

“An investor who has sold is both mentally and financially prepared to buy”

This forced-contrarian mindset allows long-term investors to anticipate sentiment shifts in advance. This is why successful investors hold more cash during bull markets, preparing for the next downturn. By embracing the emotional challenge of selling during bull markets, investors develop the mental strength to stay through the down cycle without capitulating, and also have some cash available to take advantage of juicy valuations.

Making peace with the market

In this series, we compared stock market gyrations as a series of maxima and minima. This mental model makes it obvious that one cannot jump to a future maxima without enduring the minimas in between.

Consequently, drawdown losses that occur during market corrections are a necessary cost of achieving substantial long-term returns. Even the most well-prepared investors are not expected to avoid them.

One "active" strategy that long-term investors can consider is to align their psychology against the crowd at market extremes – by selling a (small) portion of their holdings at bull-market highs and buying during corrections. While these actions are bound to cause immediate regret, they are useful in preparing investors for the next phase of the market cycle.

For long-term individual investors, this approach is preferable to a pure buy-and-hold strategy because it aligns their psychology with the market's next stage, reducing the risk of panic selling at market bottoms.

Notes

- How is this different from rebalancing? Periodic rebalancing tries to bring a portfolio back to a 60:40 or similar target allocation, thereby automatically selling in bull markets and buying in bear markets. This automatic in/out strategy applies to passive investors. Our framework is for long-term equity investors who are mostly fully invested in equities and are "active" in the sense that they are making stock selections and such.

- The framework assumes that investors hold quality stocks for the long-term and are looking to hold many stocks across market cycles, unless their fundamentals erode.

- The model applies to both the growth & value styles of investing; it does not apply to momentum which operates with shorter holding periods and stop-losses.

- Investors who hold stocks across cycles do not care about using stop-losses and portfolio insurance; anyways the costs of such hedging are prohibitive in the long-term.

- This framework is for individual investors who are targeting absolute returns, and does not apply to fund managers who have to track an index on an annual basis.

Member discussion